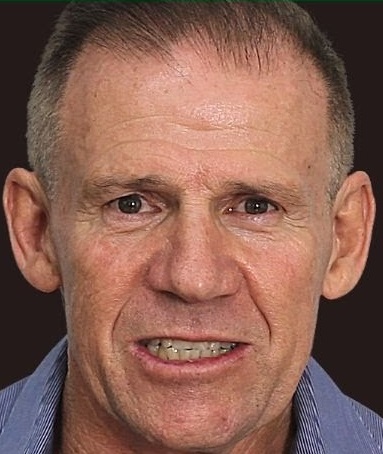

Douglas Graeme McCoy, conman first class with honours.

Close associates include Les Cheers aka John Alexander, and Dominique Grubisa, low and guilty grub who bleeds vulnerable people.

| Since launching on February 5, 2011, we have survived death threats, beaten hackers, won law suits against us, exposed dozens of scammers, and managed to recover vast funds for victims. |

DOUGLAS GRAEME McCOY, ONE OF AUSTRALIA'S WORST GRUBS!

Just for the record, McCoy's history of conning people goes way back to beyond 1994 - that's right, over 30 years of professional scamming! Pasted below is taken from the NSW Parliament question time

NSW Parliament Questions and answers April 14, 1994

Page 725

*562 DOUGLAS GRAEME McCOY—Mr Amery asked the Minister for Consumer Affairs,

Minister Assisting the Minister for Roads and Minister Assisting the Minister

for Transport—

(1) How many complaints have been received by the

Department of Consumer Affairs concerning the operations of Douglas Graeme

McCoy and his group of companies?

(2) In what year were these complaints lodged?

(3) How many different company names were involved in these complaints?

(4) What are the names of the companies?

(5) What action has been taken?

(6) What is the result of these actions?

Answer—

(1) Mr Douglas Graeme McCoy personally, and his

group of companies, have generated a total of 48 formal complaints since 1985.

(2) Year No. of complaints

1985 9

1986 13

1987 2

1992 20

1993 3

1994 1

(3) Five different company names were involved in

these complaints.

(4) Doug McCoy Management Pty Ltd trading as Self Reliance.

Security Concepts International Pty Ltd.

Australian Security and Fire Systems (NSW) Pty Ltd.

IEC Crimewatch Pty Ltd.

Cost Cutter Coupons Pty Ltd.

(5) On 14 March 1986, Doug McCoy Management Pty Ltd

trading as Self Reliance was named in Parliament on the basis of serious

complaints from people misled by false claims of potential earnings and

encouraged to pay for security equipment to be used in sales demonstrations.

The company subsequently ceased trading in New South Wales.

In 1992, following receipt of complaints from people throughout Australia who

had paid Mr McCoy and his companies for distributorships of fire and security

equipment, the Department undertook an investigation in conjunction with the

Trade Practices Commission.

(6) Pursuant to provisions under the Trade Practices Act enabling enforcement

through the Federal Court, the Commission sought undertakings from Mr McCoy

intended to restrain him and his companies from unethical and unlawful trading

practices. Mr McCoy failed to provide the undertakings, however, the sale of

distributorships ceased.

The Department of Consumer Affairs has co-operated with the NSW Police Service

which has initiated criminal proceedings against Mr McCoy. These matters are

currently before the courts.

FURTHER IMPORTANT BACKGROUND Read also the NSW Parliament Hansard record concerning McCoy here

Latest outrage of McCoy's: As it happens today, January 15, 2024. McCoy accompanied by his personal 'squeeze" May (see below) arrived at the home of an 82 year old lady at Woodridge QLD at around 2.30 am and, thumping on the door, demanded a trailer and money. McCoy is claiming that he owns the trailer and needs it and money so he can go to Aruga Close Collingwood Park to retrieve some goods from that house from which he was evicted. The old lady is the mother of one of our informants. Police were called to the house.

Read about McCoy's latest eviction here.

Latest news: October 2023. We have been informed by a reliable source that McCoy is now trying to sell shares in a Queensland gold mine. The mine is allegedly owned by another of McCoy's conmen friends, one John Foley. There's more on 'Goldfinger' and his role helping McCoy and Les Cheers elsewhere in Wikifrauds.

The Uptown Villas Scam:

Two of McCoy's partners are Priscilla James (Choi), a devotee of Dominique Grubisa, and and Graeme Cook - read below. This pair along with McCoy have enticed at least eight victims into investing approximately $1.785 Million in investments in a property development scam with convicted fraudster 'John Alexander"', which went sour when the supposed purchase fell through. The clients are still waiting for their money to be returned and have contacted us seeking our assistance. We are happy to provide further details on request, contact us. The supposed development is located at 4603 Beaudesert Nerang Rd, Beaudesert QLD. Go to This is a complete scam promising amazing returns on investments. Parent website for this scam is southeastqldhomeandland.com.au

Priscilla James, Dynamo Realty Graeme Cook, Dynamo Realty Les Cheers AKA 'John Alexander' Michael Delport, the frustrated owner John Rivett, crooked lawyer acting for

These two from Dynamo Realty, Helensvale QLD sold investments in a Claims to be developer of Uptown Villas of the land at Beaudesert. Did Delport Cheers, and making dozens of

scam development at Beaudesert supposedly owned by Cheers. at Beaudesert QLD - in fact he has no receive any of the missing $1.785M ? promises of returning money to

interest in that land whatsoever. We think so.! victims. We have all his emailed promises..

These three are amongst Australia's worst ever con artists.

And also coming soon: We expose McCoy's latest 'assistant', a former Sydney prostitute and heroine addict called May Brown, who cons people for advance payments for accommodation in McCoy's Ashford pub. They don't get to stay there and get no refund, and May the harlot rushes down to Inverell and buys $600 shoes!

In one case, a boy scout group paid a cash up in advance front for accommodation. The cash deposit was paid to May who stated she would send them a receipt when McCoy was available. No receipt was forthcoming, and neither was a refund.

The McCoy Decoy . . . McCoy's 'current partner', alleged former prostitute and heroine addict "May". We say 'current' as we know McCoy dumps his female companions as soon as they have run out of money or cease being useful. We bet May doesn't know about McCoy's other girlfriend - a blonde on the Gold Coast who drives a white Mercedes. Her name is Faaz and she hails from Sovereign Island. Well May, we wonder how often McCoy grabs her by the fuzz. He's a known two-timer May, so just ask him!

Latest on May, January 2025: One of our informants, who is also owed money by McCoy, has told us that May has left McCoy because he failed to make personnel loan repayments she arranged for McCoy. We are advised that McCoy created fraudulent pay slips in May's name in order for her to obtain a couple of personnel loans from banks. The loans were in her name, but the proceeds were given to McCoy. McCoy was supposed to make the repayments but, surprise surprise, he didn't do so. Now she has gone! She is well rid of this scumbag, but now carries defaults on her credit file that won't just go away. Yet another woman ruined by McCoy!

Wikifrauds has been able to confirm that McCoy owed over $50,000 to a Goondiwindi firm for installation of a cool room. McCoy, after much hassling, eventually paid only $39,000 off the debt. The owner of that business has subsequently had to sell the business. We also know of numerous other people who have been scammed by McCoy over the reburbishment of the hotel. Further, McCoy attended a church at Inverell in company with May and pleaded assistance as they were just married and homeless. The church apparently gifted the pair some $3000, and off they went, no doubt happy with their work.

In addition to all the above, we have made personal contact with a lady who worked for McCoy at the hotel in Ashford for some weeks assisting with renovations. McCoy only paid her for the first couple of weeks then stopped paying her despite her pleas. She had a mortgage to service, told McCoy this, but he refused to pay her. She is owed around $6000 in unpaid wages. She also told us that the chef quit after he wasn't being paid. McCoy owes him a few grand in wages also!

Now we hear from this lady that McCoy and May are intimidating her in a big way. Here's part of an email we received from her today (Aug 30, 2023):

"There has been a post put up on your Web site Regarding The Ashford hotel and Douglas McCoy I’m asking for it to be removed as I have been constantly harassed and threatened."

There's no end to what this rotten bastard McCoy will do to trusting people. He is a narcissistic sociopathic liar with not an ounce of conscience. Luckily the lady in question recorded some conversations with both McCoy and May, and she has forwarded those to us.We will share these with interested persons upon request.

August 2023: We expect that since republishing this page on August 1st, McCoy will hit back by publishing bullshit about the owner and editor of Wikifrauds. He has done this before and everything he published was either a lie or selected facts taken out of context.

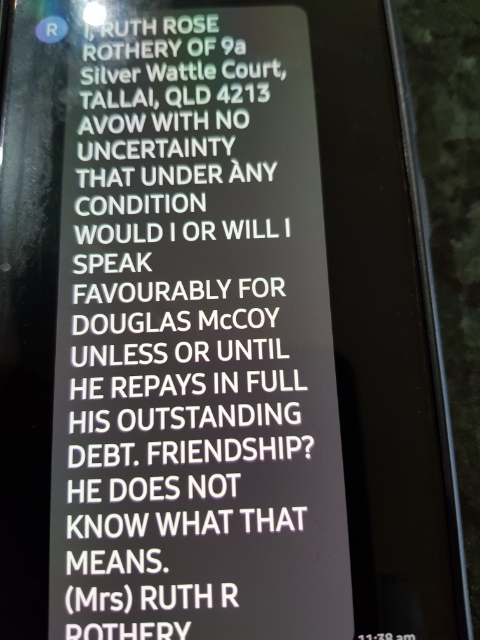

June 27, 2022 Update: We took McCoy off Wikifrauds for a while in a deal that involved him catching up repayments to one of his victims, Ruth Rotherey. McCoy was several months in arrears.but promised to catch up if we removed him from our website. However, he demanded that we agree to never publish anything further about him, regardless of what it may be or when it might occur. Of course we refused these terms amd have now republished. But ! It turns out that the money McCoy had paid thus far was actually paid by John Alexander, not McCoy! He has not paid a cent!

Subsequently in July 2023 we were contacted by "Max" from Perth WA and given full details of yet a further scam by McCoy and Cheers to the tune of $240,000. It is fully detailed on our page on Cheers.

Looking for McCoy? We are reliably informed that he is now the proprietor of the Commercial Hotel in Ashford NSW near the Queensland border, not far from Grenfell. People in that area are warned about doing any business with McCoy, or if you do, count your fingers afterwards.

This page is to be further updated in the next few days, and we will be posting a list of McCoy's victims and first-hand descriptions of his scams.

For now, here's the very latest complaint from a disabled pensioner received only last weekend June 25,2022. The email is pasted below, however we will not publish the sender's details.

"Hi. I would like to tell you that I have been conned by Douglas McCoy. He moved into the duplex in front of my place back on 31/3/20 stating that he was the new owner of the property and that I would now be paying rent to him directly. I believed him as the property had been on the market for the previous four years that I had lived there. When my lease with the previous real estate was due for renewal I told him and he said to just now say that I had a 22 month lease ongoing with him. I spoke to the RTA about this and they said that it would be classed as a periodic lease. I have been suspicious of Douglas right from the beginning especially when I googled him and saw him on wikifraud but all attempts by me to get confirmation of his ownership of the property lead to nothing until now. I kept getting mail for the previous owner Rajan Adhikari as he used to live in my duplex before I moved in and without checking who the mail was addressed to I was opening them. They were from the bank who he had mortgaged the property with requesting payment for the loan addressing him as the registered owner so this time I once again contacted the solicitors acting for them, this time in writing explaining how Douglas McCoy had bought the property two years ago and that I had been paying him rent all this time and had proof of my payments and they replied saying that the bank is taking possession of the property and that I would have to vacate. We are in a rental crisis, my only income is the disability pension so I am going to be homeless all thanks to these two men. They are friends with each other and made this arrangement for Douglas to take over the management of the property as confirmed by the previous real estate agent. I am now looking into suing them for fraud.

In answer to a question from us, a further email reply details how much rent she paid McCoy thinking he was the owner: "$26000 at $250 per week over two years and two months"

This man is perhaps Australia's worst serial conman with a continuous history of scams going right back to the 1980's. And nearly all his scams have been against vulnerable older women. Here's a short list of scammed victims - first names only. We have had detailed and frequent correspondence from each of these ladies: Ruth, Eleanor, Gilda, Theresia, Narelle, Toni, Maria and Nayaran. There are a few more who wish to remain nameless. Every one of them were sucked in with the promise of high rewards for their investment. The only rewards were that they all lost their money. One (Ruth) lost over $750,000 and another (Eleanor) has lost her property worth well over a million dollars.

_________________________________________________________________________________________________________________________________________________________________

McCoy has been named "The King of Conmen" in the NSW Parliament by Health Minister Brad Hazzard. See Hansard record. We quizzed McCoy about the Hansard record, and now copied and pasted below is his defamatory reply. We DO NOT believe a word of McCoy's defamation of this highly respected and honorable servant of the people of NSW.

"Mr Foley was Hazzard's sleeping partner, or girlfriend

He's TRIED FIRST to extort $200,000 off me.

Hazzard said: "I know there is nothing we can do legally, BUT

if you don't pay Mrs Foley $200,000 I will mention you in Parliament.

Thanks for your interest.

__________________________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________ LATEST: April 29, 2022 McCoy defaults on repayment plan for one of his victims.

We removed McCoy from Wikifrauds late last year after he entered into a repayment agreement. He has now defaulted on the last payment which was due today. This page will remain in place until he resumes the payments. But not only did McCoy default, which resuted in republication of ths page, he then demanded the return of some $30,000 we collected on behalf of a victim!

We also know that McCoy somehow managed to cheat his way into aquiring a hotel in Ashford in northern NSW. . . full story coming soon.

August 18, 2021 McCoy is now spruiking real estate investments that will return 400%

Go to Dove Property Group | Home & Land Packages in SEQLD and Positive Cashflow Properties! (southeastqldhomeandland.com.au)

This proposal is full of holes, and furthermore, is owned by a twice convicted and twice jailed fraudster, Les Cheers. Contact us for further information.

May 27,2021 We have been advised by a confidential source that McCoy wants to negotiate a victim repayment plan ... let's see what develops!

. . . absolutely nothing eventuated. It was a con job to get him off Wikifrauds. but after a fortnight, we had to put this conman back on our site.

May 28, 2021 . . For a man who openly boasts earnings of $11 million per year, McCoy couldn't even come up with a piddling $1500 to kick-start the repayment plan.

What a time wasting fraudulent lying goose. And he wanted us to take him off Wikifrauds for a fortnight before commencing repayments - we figure this request was

because he has another deal (con job) in the pipeline and doesn't want the other party to read all about him on this website.

June 11, 2021 McCoy defaulted on his first scheduled repayment. It seems that he was just trying to buy some clean air time while he swindled someone else. It will come out, it

allways does, somebody will contact us soon with yet another sad story of being conned.

He can come off this website when and only when he commences a repayment plan and makes the first payment. Any subsequent failure to make the agreed monthly repayment will immediately result in republishing this webpage.

Dominique Grubisa, McCoy's idol.

Latest: McCoy's close ally Dominique Grubisa has licence cancelled by ASIC:

See also McCoy's own list of achievements he claims. We have rarely read such a load of bragging grabage. Link

Where's the Truth. Why, if McCoy earns $11 Million per year as he claims on his facebook video, has he connned older single women out of hundreds of thousands of dollars? And if he earns such huge amounts of money, how come he has an Australian Pensioner Concession card? (He has admitted that to one of his victims in an email, a copy of which we have).Perhaps the ATO and or Centrelink should review his situation.

Why did McCoy associate with this known grub, Dominique Grubisa. We have been advised by an informant that Grubisa did a lot of public spruiking, and interested parties were directed into the arms of McCoy.

Dominique spruiking her best falsehoods.

Dominique spruiking her best falsehoods.Why have at least three elderly women laid complaints to police?

Why does McCoy refuse to repay a three-month loan of $50.000 to Mrs Ruth Rothery? And if he earns $11 million a year as he claims, why did he need to borrow that $50k in the first place? More contradictions from this dodgy conman. Nothing he claims ever adds up.

Latest lie: McCoy's latest and close to his worst lie yet, followed his confronting Mrs Rothery and her daughter Sylvia at their church on Sunday January 24 2021, when he stated that he had paid some $40,000 of his debt owed to Ruth to a Mr Ray Powell on her behalf. This was an absolute lie, he has not made such a payment and Mr Powell has confirmed to Wikifrauds that he has not received any such payment. We have emailed McCoy requesting proof of the payment. He has not replied. This matter is again a contradiction; McCoy has all along denied owing Mrs Rothery any money at all, so why this lie about making a payment?

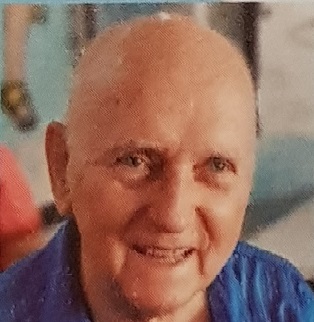

A narrative from one of McCoy's victims, now aged 91. This is from enmails to us from Mrs Rothery, and shows how McCoy used Grubisa's tactics to con her out of everything she had.:

Email to Wikifrauds dated Feb 4, 2021 ". . Brad Alfred warned me of a scam being perpetrated on the Gold Coast against vulnerable oldies & my response at that moment with Doug sitting near me was "Oh Brad, it's too late. They've already got all my money". Doug didn't even raise an eyebrow or ever admit he was in the scam!!! So, note well. He knew that $50,000 he "borrowed" that October- he KNEW quite well that it was the last of my money because HE WAS THE ONE WHO DROVE ME TO WHERE WAS THE OFFICE OF THE PERSON WHO WAS PAYING ME ON THE SALE OF THE PROPERTY I HAD IN BANORA POINT!! So he KNEW the exact amount of that Bank cheque as I had to put it into my account & withdraw sufficient to pay for the washing machine I had had ALDI set aside for me & then Doug took me to pick it up at Tweed Heads & bring it to my place". This demonstrates the use of Grubisa's tactics in searching default and court listings to find vulnerable people with some distressed assets. And it shows just how low McCoy stooped to get her money - he even drove her to collect the money!

Further:

"It was $50,000 he "borrowed from me with a guarantee IF HE DID NOT REPAY IN FULL IT WOULD AMOUNT AN EXTRA $5,000 PER MONTH ON TOP. HE MADE UP THE CONTRACT NOT ANY LAWYER & HE ASSURED ME THAT I WOULD HAVE IT BEFORE CHRISTMAS of that year assuring me it was very short term to pay wages to the group who had done the labour at the property in Wellington. Of course at the time & this is over 4'-5 years ago, at that time I did not know that he was part of the FORSYTHE set-up & had been involved right from the start so he fleeced me both ways. From that personal loan & from his cut of my hard-earned & saved money over many years!!! And he it was who brought Jim Boguevski (?) to my place so he was in on it even before it even got under way".

We have repeatedly asked the question of McCoy that if he earns eleven million per year as he has publicly claimed many times, why did he need to borrow a mere $50,000 from an old lady?

McCoy has recently published his "counter website" alleging all sorts of accusations against us and the editor. Not a word of it is accurate or true. He's desperate to shut us down and will get into bed with any other crooks to achieve this aim.

McCOY NOW USES FACEBOOK TO LURE MORE VICTIMS - DO NOT DO BUSINESS WITH THIS CONMAN. Check Facebook link to his "Billionaire Mind Magnet" page above. The only thing McCoy creates is misery and losers. There are no winners, except McCoy, who will readily snatch your money, all of it. If one watches his video (on the facebook link) wherein he claims to be making eleven million dollars a year, the question raised is why won't he repay a simple piddling $50,000 three-month personal loan? And if he was making all that huge amount of money, why did he need to borrow $50k in the first place? Does not add up. Go figure! This man is a true liar of gigantic proportions.

July 29, 2020: McCoy emails us confirmation of his collaboration with other criminals named on this website. Below is a pasted copy of his latest email. This guy and his mates confirm that they tried and failed to acquire our website and now want some sort of deal whereby they will remove McCoy's website on Wikifrauds if we remove our pages on this collective of bottom-feeders: (our comments are in red)

"Thank you for your acknowledgment of my Copywrited name and acknowledging that you know you owe me $530,000 for each breach!! Appreciate it. (Never acknowledged by us)

McCoy threatens us:A threatening voicemail message was left on the private phone of the editor on June 28, 2020, around midday. McCoy must be stupid as the missed call showed the caller's number as 0449 971220. A simple lookup on Google showed the number as being McCoy's. What an idiot! He needs to read some good spook books and learn a little "tradecraft". Another threat issued by one of his co-conspirators can be heard here. This has also been given to police.

McCoy's copycat Wikifrauds website: McCoy, in an effort to discredit us, has published his own website which contains complete fabrications about us and the editor. There is nothing this conman will stop at to protect his scams and his bogus company, the Australian Success Academy.

July 14, 2020: McCoy email to us, what a joke:

"Detective,

ALL RIGHTS RESERVED"

Mr McCoy, who says he earns over $11,000,000,000 (eleven million!) per year (but can't repay a $50k loan), should have some lessons in English expression,

and maybe some law text books would help also. He mentions some two

dollar lawyer in the USA, yet he is a close personal friend of

barrister John Foley. Why not use Foley to sue us? And since when does

one's personal name become copyrighted. What a pitiful joke for a

supposed sophisticated and successful businessman. The man is derranged

and paranoid. All he has to do to have his name removed is to repay his $50k loan plus interest to Mrs Ruth Rothery.

McCoy intimidates one of his victims on Tuesday March 10

Independant mediator's report.

Conmen Associates of McCoy's:

Keith Kelly John Foley "Goldfinger" Jim Bogevski Clarence Boyd Nelson

We understand McCoy's Wellington place is this one.. . . on Arthur St. It was fraudulently valued at just under $1M based on a ficticious lease agreement to enable McCoy to raise "working capital"

McCoy's latest eviction:.

McCoy took up residence, as a tenant, in 7 Brugha Close, Collingwood Park, a suburb of the city of Ipswich, QLD. The property had two premises, namely 1/7 and 2/7. McCoy was in one of these two tenanted units.The property was owned by Rajan Adhikari and had a mortgage to Westpac Corporation.

Mr Adhikari had to leave Australia urgently for reasons unknown, and left McCoy in charge. So, McCoy then tells the other tenant, a lady who was rather naive, that he McCoy now owns the property, and that the rent should now be paid directly to him and not the estate agent. She readily complies, not knowing anything to the contrary, and not checking with the estate agent. McCoy pockets all her rental payments and doesn't pay his own rent. Of course it was only a matter of time before the bank foreclosed. But then McCoy sought to stay the foreclosure and even had the cheek to challenge Wespac in court. Naturally he lost and was kicked out. Nobody knows what happened to the luckless Mr Adhikari. The court findings can be read here.

"He (McCoy) phoned me one day to say that he and Joan had to move out of the container in which they were living on his sister'place as one of her kids needed to move back there, and would they be able to come and live in my old Dairy. He was aware that it had been rebuild years earlier as a 3 bedroom cottage instead of being an 8 bail milking shed, but was still very basic. At that stage, the plans that Ruth, John Foley and Doug for my flats in Dornoch Terrace had gone up in smoke, thanks to John (Foley) and all his lies to both R and me. The bank had repossessed and sold the place. Another long saga. John and D had taken R's co and renamed it Rutlin P/L.

The

caveat had an email address on it which when my solicitor checked up on it was

registered to someone in San Francisco. USA. I later came across some

information which has led me to believe that he is actually registered in

Australia, as Michael Douglas McCoy and uses Douglas Graeme McCoy as a false

identity. His pension card is in the name of Michael Douglas.

Associates of McCoy's, or

should we say current co-conspirators, are pictured at the head of this

page. We make this point again as it is our firm belief that John

Foley, "Mr Goldfinger", sells his name and gives his recommendations to

McCoy's victims. His apparent wealth and his educated demeanour make

for an easy endorsement of the investments promoted by McCoy.

He even flashes a few gold bars he keeps in his Q1 apartment on the

Gold Coast. The man is a barrister, an Officer of the Courts. What a

disgrace! And he was a director of Forsythe Manufacturing at the time

that both Eleanor and Ruth were conned into the fatal investment.

Forsythe subsequently went bust ayway, so at the very least, all the

directors including Foley should answer to the allegation of trading

whilst insolvent.

Eleanor has been ruined, and Ruth has lost many hundred's of thousands of dollars to Forsythe and its gang of criminal directors and shareholders. Principal architects of the scam include all those who appear at the top of this page. As for McCoy and Foley, they were rewarded for their services by Forsythe with shares or directorships etc. See ASIC Company Extract.

McCoy intimidates Ruth Rothery on Tuesday March 10, 2020:

We have been advised that McCoy and his mother arrived unannounced at Mrs Rothery's property on Tuesday around lunchtime. His mother remained in his latest car while McCoy conversed for some time with Mrs Rothery. He badgered her about what he had done for her (apart from relieving her of $50,000) in trying to assist her with other bullshit endeavours. When Mrs Rothery asked him several times about him repaying her $50k loan, he swerved the question each time and just went on and on about how good he had been to her. It's clear that he was looking to get his name off Wikifrauds and to pursuade her to keep silent. There are not too many scammers who prey on elderly defenceless women, and McCoy is the very worst of these bottom feeders. He has threatened us with legal action on countless times, but he hasn't got the balls to do it.

Further, we have now received copies of correspondence from McCoy to Ruth Rothery, some quite threatening. Unfortunately, McCoy, who we think is bi-polar and a control freak, has a tendancy to rant on at a nauseas level and his letters just go round in repetitive circles page after page, so we have produced below a lot of this correspondence in one pdf file. Sorry to you the readers for having to see so much diatribe from this conman. These combined letters to Ruth are absolutely full of malicious accusations, excuses, lies, threats and blame-shifting from McCoy. See pdf file.

Independent mediator's report:

“I Douglas James Reti of 40 Angelsey Street Kangaroo Point Qld

write this testimonial to assert that as requested by Mrs Ruth Rothery I did act as mediator concerning a debt between the above & Mr Douglas McCoy of $50,000 +loaned on or about 10 October 2017. According to Mrs. Rothery the debt was to be for a maximum period of 8 weeks covered by a written contract between the 2 parties. The contract stated that the loan would attract an immediate return of $5000 & thereafter a further $5000 per month on the same date until paid in full. Mrs Rothery Jas not received any repayments or interest on this loan.

Mr Douglas McCoy stated that he had sold the contract to Mr John Alexander. Mrs Rothery claimed that this would be illegal as she had not given any authority for this to happen & Mr McCoy was of the opinion that he had the right to do so. During the meeting I observed that Mrs Rothery had prepared direct & precise questions to which Mr McCoy was unwilling to take responsibility & provide any further information other than the loan belonged to Mr Alexander & it was up to him to make repayments.

MRS Rothery has since contacted Mr Alexander whose real name is Xxxxxx, who adamantly denies any such AGREEMENT.

MRS Rothery has informed me that she has placed her case with detectives of the CIB Southern Investigation Branch.”

We also now have a listing of who obtained what amounts of Ruth's total monies lost in addition to what she lent to McCoy direct. This has been provided by an insider, and we have no reason to doubt the email contents. Our observations and comments are in red.

"This

is from memory and is not to the dollar it is a big ask with no paperwork to

back it up

The

companies and directors that got ruths money

KK

Developments p/l Director Kelly We ave reason to believe that KK developments and Forsyth are owned by Clarence Boyd Nelson.

BL

Retirement living p/l Nelson The same Nelson as above.

to

the best of my knowledge this is where the money went

Rent

Factory Keysbough Victoria $100,000.00 plus Supposedly owned by Forsyth (John Alexander, Keith Kelly, Boyd Nelson)

Leases

on cars

$80,000.00 plus

Deposit

on land Beenleigh $50,000.00

plus

Buying

a second mortgage from a builder who had already lost the block to a first mort

gee

$85,000.00

Jim

$50,000.00 Jim Bogoevski, shares accomodation with Nelson

Nelson

$20,000.00 Clarence Boyd Nelson, Gold Coast Solicitor.

Kelly

$20,000.00

McCoy

Brokerage

$20,000.00

McCoy

borrowed

$60,000.00

LMC

Money borrowed went into kk Dev $60,000.00 Keith Kelly along with Nelson at the helm

Silver

chef equipment Victoria $80,0000.00

plus Forsythe

This

is to the best of my knowledge but a lot more cash went elsewhere at the

request of Jim and nelson That's Jim Bogoevski and Boyd Nelson.

"PS

Re Foleys involvement he was introduced to me by McCoy stating that he could

get the overall funding for Forsythe manufacturing and the ice cream ,Foley

said that it would be easier for him to get the money if he was a director and

shareholder ,he then said that McCoy should get some shares as with the money

that he could raise giving away shares did not matter the rest is history

Regards L"

McCoy has also told Ruth that he paid some $10,000 to have his name removed from our website. A complete baldfaced lie. And we must add that should he ever pay anything to us remove his "good name", any such money would be passed on to Ruth and Eleanor. This man just can't help telling lies and conning anyone he can.

Another large con was perpetrated on Ruth a few years ago. McCoy talked her into lending him $50,000 for renovations on a house in Wellington NSW. She lent him the money but wisely took a caveat out on the property. McCoy has not paid one cent back to her and refuses to do so. So he can't sell the property, but doesn't want to anyway, so poor old Ruth, who is in her nineties, is left swinging in the breeze. The loan was for a couple of months only!

A copy of this caveat that McCoy denies having lodged can be viewed here.

We have several copies of these bogus and unenforceable agreements upon which he has relied to lodge the caveats mentioned, and we will publish more of these in coming days. Read below how Mrs R's money was distributed and to whom. This has come from an informant who was in on the deal, one Les Cheers. It is pasted from a text message from him to our contact. We have idicated in red who these people are.

Raymond

Kk dev $250,000

Nelson. $450000

Jim. $100,000

McCoy. $60,000.00

Me.on behalf kk $60,000.00

Raymond that is as close as I can get it Regards Led Sent from my iPhone

McCoy's business is "The Australasian Success Academy", which Google tells us used to have a website but we found all links to it went nowhere. The only "success" we know of is his scamming of old women, usually in concert with Kelly, John Alexander, Clarence Boyd Nelson, and another con artist broker, Jim Bogoevski who also owes over $100,000 to Mrs R.

THE NSW PARLIAMENT HANSARD REPORT:

MR DOUGLAS McCOY INVESTMENT ACTIVITIES

Mr BRAD HAZZARD (Wakehurst) [1.31 p.m.]: In life there are scam merchants and then there is the king of the scammers—one Douglas Graeme McCoy. I draw attention to this conman who knows no State boundaries and no moral boundaries. In 2005 a northern beaches woman, Therese Foley, received advice from an acquaintance at a northern beaches church that Mr McCoy would invest her money at a particularly good interest rate. In or about February 2005 Mrs Foley invested $300,000, the proceeds of her marriage property settlement, for a period of three months with the very unaptly named Loyalty Plus Pty Limited. None of the funds has ever been repaid. Mrs Foley advised me she had contacted the New South Wales Department of Consumer Affairs and the Australian Securities and Investments Commission prior to investing the funds and was given no indication that there was a problem. The Australian Securities and Investments Commission indicated that it had no history of Mr McCoy, and the New South Wales Department of Consumer Affairs indicated that it could not give Mrs Foley any information about Mr McCoy.

Research by Mrs Foley since the loss of her money found a reference to Mr McCoy in 1994 in Parliament after Mr Richard Amery, member of Parliament, asked a question on notice. At that time Mr Amery's question produced an answer that indicated that Douglas McCoy was involved in five separate companies that had generated a total of 48 formal complaints since 1985. The response also indicated that the Department of Consumer Affairs had cooperated with the New South Wales police service in initiation of criminal proceedings against Mr McCoy, although this appears never to have happened. I am therefore amazed that the Department of Consumer Affairs offered no advice to Mrs Foley prior to her lending the funds to Mr McCoy's company when he clearly has a long history of involvement in fraudulent activities of which the department was well aware or should have been aware.

On 14 June 2007 I wrote to the Minister for Fair Trading, the Hon. Linda Burney, sending a copy of the loan agreements dated February 2005, which facilitated the investment of $300,000 for three months. The documents stated interest would be paid up front and the balance repaid at the end of the three-month term. Mrs Foley received the one interest payment back. It appears she got back some of her $300,000 as an interest payment, but the rest was never seen again. Since February 2005—today is the three-year anniversary—she has received zilch. With the benefit of the history of parliamentary questions raised over 15 years ago, it is clear that Mr McCoy has ripped off vulnerable people for almost two decades, which raises the apparent lack of capacity in the State and Federal watchdogs to act appropriately. When I first contacted the Department of Consumer Affairs and the Federal body the Australian Securities and Investments Commission, neither body had contact details for Mr McCoy. Inquiries by me turned up an address in Western Sydney and I got a mobile number for that address. Phone discussions followed with the "king of conmen".

Mr McCoy presents as a credible fellow who turns out to be utterly incredible. After my contact with him he suddenly showed up at my office on Thursday 19 July 2007 and told me that he now lived at 6 Golfview Terrace, Robina, in Queensland. Does he really? Who knows? In a 1½ hour-long talkfest Mr McCoy admitted to me that he had been in a relationship with a woman called Jacqui Blazeski, the same woman who had attended a northern beaches church with Mrs Foley and first suggested that she invest her money with him. Mr McCoy claimed he had not seen Jacqui Blazeski for 12 to 18 months and that she had lived at Bondi. He stated that Jacqui had worked for him as a secretary-personal assistant for four to five months at Loyalty Plus. It would seem more likely that Jacqui was part of the scam, hooking innocent people into Mr McCoy's financial black hole.

So what is McCoy up to today? During our meeting he told me that he had set up a business with a woman called Bridget Bryant in a company called Y Not Call Me. He maintained there were "a lot of people after her" arising out of other business dealings. He named a James Meyers in Canada, and said the company's bank account was in Delaware, in the United States. He told me that had told Mrs Foley that her money would go into a telecommunications company with millions of distributors throughout the world and that this discussion took place in his office in Pyrmont in the premises of Y Not Call Me. Mrs Foley recollects going to a presentation at a Pyrmont office, which she thought belonged to Loyalty Plus Pty Limited, where McCoy delivered his conman spiel. She told him that she had her marriage property settlement funds to invest and that effectively they were all her available funds.

At the meeting with me in July, Mr McCoy gave me chapter and verse of his tales of woe to explain why he had not repaid the money. He told me he had put up 16 properties for security for loans totalling $1.8 million. He mentioned various properties at Mumbil and Wellington, and he said he now had a place on Macleay Island, off Queensland. He mentioned another business called Self Reliance, which he had operated 20 years ago, which had also gone into liquidation after a judgement debt for half a million dollars. After listening to his conman banter I asked him to sign a document on the spot that guaranteed he would personally pay back the money to Mrs Foley. That is, instead of Loyalty Plus Pty Limited, in liquidation, being the only avenue for Mrs Foley to get her money, I asked him to sign a document saying he would pay the money personally. In the best efforts of criminals, spivs and conmen, he even posed for a photograph showing the document he had just signed, which effectively bought him another few months while Mrs Foley hoped he would pay the money.

Today is the end of the road for McCoy the conman. Nobody on the northern beaches, nobody in Sydney, and indeed nobody in Australia, should be under any misapprehension: they would have more chance of getting their money back if they stood on North Head and threw their $300,000 to the four winds. I call on the Office of Fair Trading to get its act together and ensure that in future people who make inquiries before making investments can rely on the department to give the necessary information. If someone has been on a warning list, that is where they should stay and the list should be updated. In the meantime, the people of the northern beaches want to keep a look out for a fast-talking, smooth-operating king of scammers who will rip them off as quick as look at them. Finally, Mrs Foley needs help. She needs her $300,000. If anybody knows which rock this conman is under or what assets he has that could be used to pay back Mrs Foley, I ask them to please let Therese Foley know.

Ms LINDA BURNEY (Canterbury—Minister for Fair Trading, Minister for Youth, and Minister for Volunteering) [1.36 p.m.]: I thank the member for Wakehurst for raising the issue. He has written to me and discussed the matter with my staff. The body responsible for consumer protection regarding financial services is the Australian Securities and Investments Commission. However, the Office of Fair Trading contacted the liquidator seeking further information about the circumstances of the liquidation. Fair Trading investigated Mrs Foley's complaint and is liaising with the Australian Securities and Investments Commission about Mr McCoy's investment activities and involvement with at least one failed company to determine whether any regulatory action is appropriate.

Generally, Fair Trading is not in a position to provide consumers with reputation checks unless the Minister or the Commissioner for Fair Trading has issued a current public warning about the trader's conduct that can be brought to the attention of the inquirer. In the case of Mr McCoy no public statement has been issued for more than 10 years. I place that on record, but I am very happy, as the member for Wakehurst would know, to have further discussions regarding the matter. I take on board his comments today.

Check this link to read earlier information about McCoy

This is a typical example of McCoy's cretin behaviour: We have been informed by one of his 'friends' that McCoy was caught by the traffic police for speeding. Instead of copping it sweet, the idiot fought the fine in court, which is his right of course. He dragged the case on for some six months, arguing, wriggling and squirming all the way, and still lost his case and had to pay. This is typical McCoy - he always denies any wrongdoing at all and argues and defends and justifies everything he has ever done. He never knows when enough is enough, and it's time to quit and move on. The man is a sociopathic narcissistic bi-polar idiot who actually believes everything he says.

Meantime, anyone who has further information on this man or who has also been conned, may contact us in confidence for further details.