Tim Reiter, Charles Cameron, and Mortgage Capital Partners, Melbourne. Scammers!

Information provided to Wikifrauds shows Tim Reiter to be a supposed finance broker who has taken an upfront fee of $50,000 to broker a funding deal which has never eventuated, and Reiter refuses to repay the client. We also believe that there may be a second such deal in 'process' which may also be in the same situation, but one in which this second party has paid substantially more money.

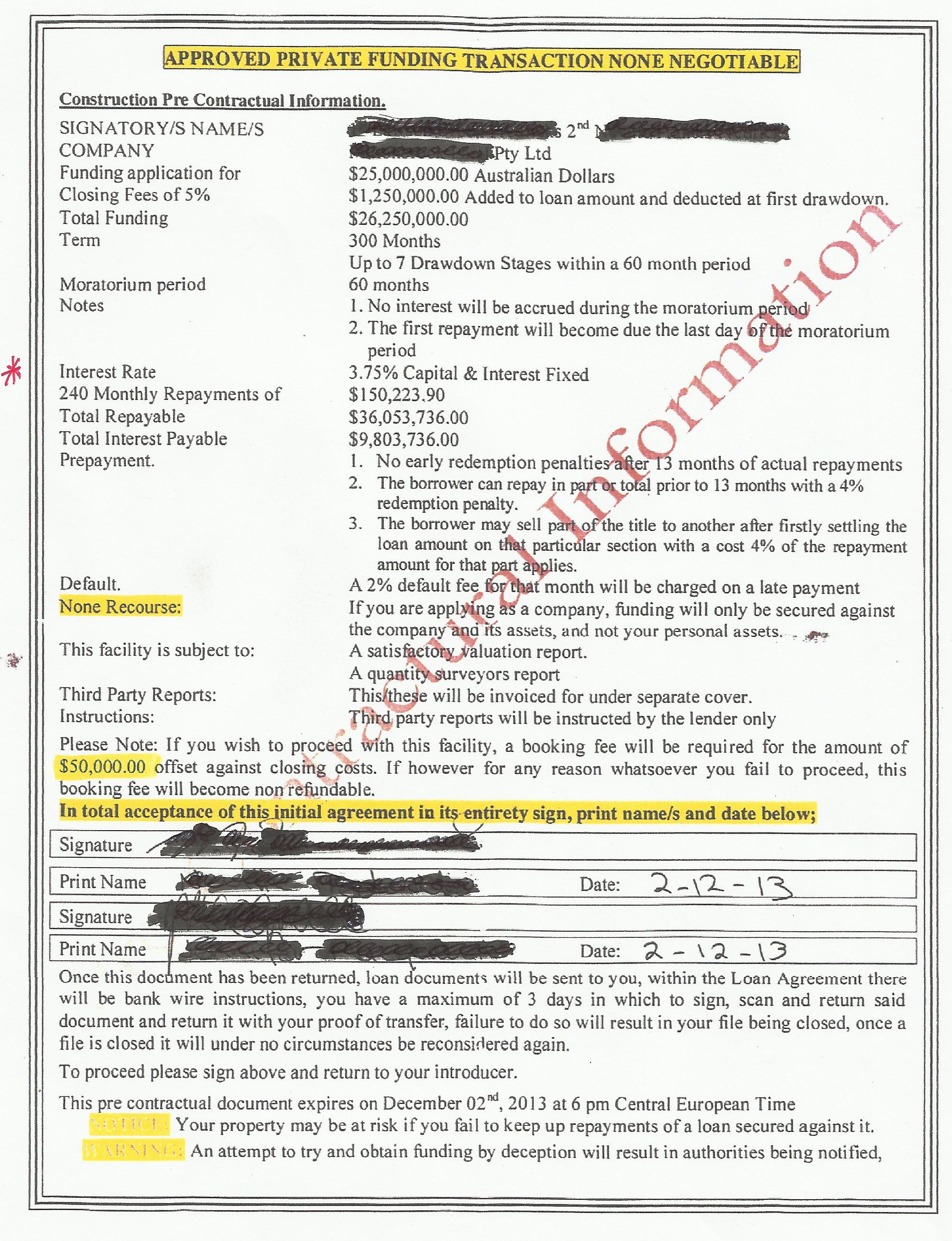

Details of the first deal are now revealed. We have 'sanitised' the documents to remove the applicant's names, and in the email below, we have altered the name of the introducer to "George X". Otherwise, the following documents are real and valid copies of the originals we have on hand.

Reiter's associates: Melburnians Richard White and Charles Cameron, and a Paul Robinson, England? Read more about Charles Cameron on these two links: Link A Link B

1. First Fraud: (See also second fraud) Reiter loses in WA Court. Judge slams his credibility. Read court findings, in particular clauses 186 -191.

·

"We were introduced to Tim Reiter through a local broker,

George X.

·

We were advised that Tim had access to foreign funds for

property development and investment. Given our past experience with overseas

loan offers we were wary, but had more confidence this time as we were dealing

with an Australian company and all fee payments etc would go through that

entity, so we felt we had some recourse if things did not turn out as expected.

We had also dealt with Tim on another loan application several years ago, so we

knew he had been operating in the Australian property finance sector for quite

some time.

·

We completed the application form and George submitted

them for us. We were advised our application was approved and we needed to fly

to Melbourne to meet Tim so that the loan could be advanced. We did so on

2nd December, 2013. The funds were to be provided by a collection of high net

worth people, and come via of Spain because there were less regulations on

international lending from there. Tim advised that’s several loan applications

were well advanced and would settle within the next two weeks.

·

We were provided with a one page pre-contractual loan

approval form (attached) and advised that to advance the loan, a $50,000 fee was

required. We would then receive the full loan document, and then proceed to a

property valuation which we would need to fund.

·

We signed the approval form and paid the $50,000 which was

invoiced by Mortgage Capital Partners Pty Ltd. We

were then advised us that the fund, Private International Finance,

was managed by Paul Robinson, an English lawyer. We couldn’t find either on the

internet.

·

The loan documentation that arrived a week later was

insubstantial (copy attached) particularly considering the quantum of the loan,

there was a short time frame to accept it. The loan document didn’t even

identify the lender and there was nowhere for the lender to sign.

·

The valuation fee was quoted at just under $80,000, well

above what we would expect to pay for a valuation . We asked to see the valuers

fee proposal but this was denied.

·

We exchanged several emails in the week following (all

attached) seeking clarification and further information to fill in the gaps in

the loan document. They were answered either by Tim Reiter or the lender, Paul

Robinson. Their responses basically added up to “sign the loan offer and pay the

valuation fee or lose your $50,000”.

·

We requested a refund on our fee from Mortgage Capital

Partners as they had invoiced us, but they had not carried through on their

promises.

·

No refund has been forthcoming.

Kind regards .... (Name withheld)"

_____________________________________________________________________________________________________________

Yet because of the more than reasonable request to call it a day and ask for a refund, Reiter relies on the some other document to withhold the client's money. NOT GOOD ENOUGH MR REITER!

Loan Documentation:

2. Below is an image of the "Terms Sheet" issued by Reiter.

Q: Whoever heard of a 30 year construction loan of $25 million (plus brokerage) at 3.75% fixed interest, and with a no-cost, no repayment term of the first five years. Sound too good to be true? Click here to see the entire loan documentation. We have a number of further emails on this matter and will release them in due course.

Update dec 2017:

2. Second Fraud (This all occurred in the months leading up to November 2017)

THIS IS THEIR STORY:

“Whilst Tim Reiter / MCG were unsuccessful in directly scamming us out of cash

– our encounter still cost us very dearly in time, professional fees, travel, damaged

reputation and missed project opportunity.

Our pursuing Tim Reiter for project finance offerings that simply didn’t exist

has certainly cost more than the $69,000 application fee that he was trying to convince

us to send him.

Our business was pursuing

project finance for power generation projects in South East Asia. This required

project finance of USD$21 Million and a funder with an appetite for SEA country

risk.

Because this was our first

project in SEA, I found Mortgage Capital Group via Google, Melbourne, who

specialised in large international project finance.

In response to my enquiry through the MCG website whilst I was in SEA, I was

phoned by a Richard White and invited to a meeting the following Saturday

morning in the MCG Melbourne office.

The meeting went well, I was in their plush offices in Melbourne CBD they felt

legit and very capable. The meeting was with MCG principals Richard White

and Charles Cameron.

I was advised that most of their project funding came from wealthy individuals in

Spain and Dubai and that our project was their core business and they would

likely be able to help.

Critically, we discussed the application and due diligence processes required as

well as the time frames and any application costs involved.

I went away from that meeting happy with what I had heard.

Whilst surprisingly there was no application brief provided by MCG, I quickly compiled

a formal bound project finance application based on all the usual information that

I expected a financier to ask for. This was emailed to Charles Cameron /

Mortgage Capital Group.

Several weeks passed with nothing meaningful coming back from MCG despite my

emailing several times and phoning. At best all I received was a generic MCG

email “application received” or “being processed”. This response and delay was

not at all what I was expecting.

Another two weeks passed with hearing absolutely nothing so I travelled back

into the offices of Mortgage Capital Group without appointment.

The first red flag was when I asked the lady at the front desk to see Charles

Cameron of or anyone from Mortgage Capital Group and she replied “who?” - So I went

back outside and phoned both Richard White and Charles Cameron to no avail, no

message service, nothing.

Very soon after Charles Cameron phoned me back (clearly he recognised my incoming

number) and he agreed to meet me at the office an hour later, so I turned up at

the agreed time.

However the next flag was being immediately greeted by Charles Cameron standing

in the lift foyer who immediately ushered me straight down to a café across the

road. I did not get anywhere near inside their office that I had previously

been to, and Charles Cameron didn’t acknowledge anyone in the office. It felt

like he wasn’t supposed to be there.

Nevertheless at the café I asked about our application to which Charles Cameron

confirmed all was in hand and progressing well and he confirmed “I see no

reason for this not to proceed”.

Again, I asked Charles to reconfirm the application process and MCG application

costs involved and how MCG earn their fees.

NOTHING was ever mentioned about any upfront MCG application fee require to be

paid. - Again, Charles Cameron ratified that our project funding was most

likely to come from either Spain or Dubai.

Next…..enter a young lady to the café who walks in unannounced that Charles introduced

to me as Sanam Ali. Charles explained that Sanam was the daughter of one of the

wealthy Dubai families that would likely support our project finance.

Sanam also confirmed this and explained that she worked in the MCG back-office

processing and approving/recommending loan applications to the wealthy Dubai fund

managers that she was connected.

So far as application requirements were concerned - the only thing Charles

Cameron did confirm was required with our application document, was that I

needed to forward copies of all our Director’s passport IDs and proof of

address which I did. In legitimate hands and just like a bank asks for, this

request is routine.

Again I phoned both Charles Cameron and Richard White again to no avail, just a dead end, not even a message service.

I then emailed Charles Cameron again advising - MCG needed to either forward a finance term sheet offer or just tell us they cannot do the deal and we will cancel our commitment to the project.

After all this effort and meetings no one returned my calls and I never heard from or saw either Charles Cameron / Richard White / Sanam Ali again.

About a week later I received a call completely out of the blue from a Tim Reiter.

I had never heard this name mentioned before. “Hello, I am Tim Reiter, the owner of Mortgage Capital Group, I have your finance term sheet offer, you had better come into our office so we can discuss it”

…….so I turn up the following day to the MCG office.

Same routine – I step out of the lift and I am immediately greeted by Tim Reiter who ushers me straight back down to the same café across the road - we never went into the office – and Tim Reiter also didn’t acknowledge anyone in the office. It was like he too wasn’t supposed to be there.

Very quickly Tim Reiter becomes forceful and aggressive “before I give you your finance offer, I require you to just settle the application fee” …and I literally blurted out “WTF?”

I was provided just an instruction, no invoice, to pay $69,000 to the account of another finance company name that I had never heard mentioned prior - it was actually a name that sounded made up.

I promptly asked Tim why after all this time I had never been made aware of this application fee requirement prior – to which Tim Reiter quickly became angry telling me. “Listen, you have wasted enough of our time already”

…..again, shocked, I blurted out “WTF – Tim – after 5 months you guys haven’t done a bloody thing?

Very quickly my intuition was screaming that this Mortgage Capital Group was likely a scam.

With now absolutely no inclination to pay Tim Reiter’s application fee, and Reiter by now just talking around in circles nonsense…I finally told Tim Reiter that I agree to pay, however I at least needed to see the finance offer first in lieu of all the stuffing around and vagueness that this MCG application has taken.

I left the meeting believing that Tim Reiter knew that I smelt b/s.

The next day Tim Reiter emailed the finance offer to me – a laughing stock is the kindest I could describe it. This was the farthest away from what I was expecting.

1. The finance offer was only an assurance that if we paid the $69,000 - our application would be looked at. I immediately thought “after 5 months these toss pots haven’t done a f**king thing.”

2. The offer was from a Brisbane finance company registered to a residential address whom had never been mentioned prior. They appeared to specialise in consumer finance and used cars.

3. Certainly there was no mention of the wealthy Spanish or Dubai funds mentioned prior.

4. Most concerning was that clearly whoever drafted the term sheet had no experience whatsoever in international project finance. Amateurish and unsophisticated best described Tim Reiter’s offer.

Finance documentation for hire purchasing a used car is more sophisticated than this – Tim Reiter’s finance offer was not even adequate to hire purchase a colour TV – yet this was supposed to cover USD$21M !!!

5. Again, Time Reiter’s total focus by email became the payment of the $69,000 application fee. Aggressively Tim Reiter insisted that unless this was paid immediately - no further discussion would be entered as I had wasted enough of his time already.

I was quickly at the realisation that there would be no project finance - and that Tim Reiter, et al, was very likely a scamming ring.

Whatever Tim Reiter was peddling was at best a nonsense.

My list of questions of Tim Reiter / MCG including Charles Cameron and Sanam Ali had only grown to a mile long – and I emailed these to Tim Reiter and Charles Cameron.

I ratified that we were ready to pay the required $69,000 on answering provided to our questions – however we never heard from Tim Reiter or anyone else from MCG again.

The total experience with Mortgage Capital Group and all involved was so suspicious and sour after receiving the finance “offer” and the demand for the fee payment - that it prompted me to commence searching online for their association with any scams - hence my story ended up on Wikifrauds.

CONNECTING ALL THE DOTS;

1. I have no doubt that Tim Reiter, et al, and Mortgage Capital Group is very likely a scam.

I don’t believe anything was actually done with our original finance application supplied to MCG / Charles Cameron.

> Even if MCG were perfectly legit financiers, they would be incapable of writing any business whatsoever.

> Tim Reiter’s business is either scamming “application fees” for finance that simply does not exist…….or ID theft (through requesting passport ID’s and proof of address)……or both.

> We have absolutely no doubt whatsoever that if we had paid the $69,000 we would have never heard from anyone at MCG again. At best if they did bother to respond, all we would have likely been given is a brief email communication that our finance application was simply either ‘non-compliant’ or ‘unsuccessful’ - and that would be our cash GONE!

2. Tim Reiter / MCG were not even smart in the business of scamming.

Professional scammers are normally highly organised and very sophisticated, armed with a ready answer for every possible question put to them, or online research conducted against them. Yet rank amateurs best describes Tim Reiter, Charles Cameron and the MCG crew.

For example;

> All people I encountered with MCG were vague and all over the shop – nothing was consistent, there was no plan, clearly nothing was thought through.

> Their was no explanation provided to any obviously question – such as why a plush office in Melbourne CBD connected to a wealthy Spanish or Dubai private investment fund – ends up at a previously undisclosed suburban residential address in Queensland.

> No one in MCG seemed remotely concerned about our business, the project, construction costs, the risks, our personnel involved, or how the money borrowed would be repaid. MCG only focus was the application fee.

> Tim Reiter and Charles Cameron had very vague Linked-In profiles, in conjunction no direct contact details, not even a direct email or phone message. These guys were at best vague, at worst they were completely untraceable.

> The corporate details of MCG were vague/completely untraceable. The registered details within ASIC for Mortgage Capital Group did not even exist.

> There was however a Mortgage Capital Partners Pty Ltd registered that pointed to yet another address and director personnel that I had never heard of, despite Tim Reiter introducing himself to me as “the owner”.

I knew that this entity was connected to MCG as this company had the MCG website is registered.

However in yet another surprise, Mortgage Capital Partners Pty Ltd and the MCG website was registered to addresses in Sydney and the USA.

> MCG had no project / client references, the website was just full of flash photos of buildings under construction and over used corporate platitudes.

> MCG only operated mobile phones and a generic email address. There were no business cards, no name on the door, no ABN, no brochures, no staff, no front desk reception, no formal communication, no formal finance application or due diligence processes

> Mortgage Capital Group most likely did not even occupy the CBD offices that I first visited. Not a single reference to MCG, not even a name in the foyer directory. No-one on reception had even heard of Mortgage Capital Group or Charles Cameron.

When I showed up unannounced during business hours and I asked to see Charles Cameron or someone from MCG – I made it no further than the lift lobby.

The only explanation that I can come up with is that the first introductory meeting that was requested by Richard White – was on a Saturday morning – when noone else was there. At best the CBD office probably belonged to an unrelated associate they had a loose association.

UPDATED early 2022

Since our experience detailed above and per the two links at the top of this page, we have since discovered that Charles Cameron and Sanam Ali have both been prosecuted / convicted for dishonesty charges by ACCC associated with a GeoWash Carwash franchises across Australia involving a long line of people left out of pocket and involving millions of dollars.

None of what we read on this surprises us in the least. Just more of the same vague, loose, dishonest bullsh*t.

There is a YouTube clip of Sanam Ali giving and interview at a Franchise trade show detailing GeoWash. This was filmed around the same time as we were pursuing them.

This video depicts exactly the same Sanam Ali that I remember – vauge and clearly very unsure of the business she is promoting. Unsurprisingly all comments for that clip have since been de-activated.

Whilst there is not a single trace of an image of Charles Cameron online, however looking at Sanam Ali’s online profile she portrays herself as a stereotypical high maintenance glamour puss – living an unsustainable high life via a façade of flawed/empty big business and flash cars - very likely all funded using other peoples money. There is a well-worn saying; “an empty vessel - makes the most noise.”

To quote the ACCC prosecution / judgements recorded against Sanam Ali and Charles Cameron:

https://thewest.com.au/news/court-justice/carwash-queen-sanam-alis-life-in-the-farce-lane-ng-b881104006z

“Sanam Ali: the former GeoWash car wash queen was like the businesses her franchisees thought they were buying into - a lot of froth and bubble - When that drained away, a string of franchisees were left with big holes in their bank balance and not much to show for it – empty promises.”

“Unconscionable conduct - false representations - failing to act in good faith - In other words, Ali was full of it. And not just about the business.”

“The business — and her own experience — was characterised by lies, exaggeration and misrepresentation”, underpinning a business model that was “inherently dishonest” – they acted unconscionably in dealings with potential franchisees.”

“While they were telling prospective franchisees their cash outlay would go towards the set-up of their business, in fact it went to a pot of cash from which Ali and Cameron paid themselves.”

“It involved creating the false impression the money paid to GeoWash by franchisees would go towards the costs of the fit-out for their outlet when, in fact, Ali and Cameron intended to pay large amounts to themselves from those monies,”

“A lot of the money often went to Ms Ali — who pocketed $1,766,305 in four years — Mr Cameron and his wife. As a result a string of franchisees were left without a business or money.”

“In January of this year, the Court ordered $4.2 million in penalties against Geowash, its director Ms Sanam Ali and its franchising manager Mr Charles Cameron.”

“This included penalties of $1.045 million against Ms Ali and $656,000 against Mr Cameron.”

“The Court also ordered Ms Ali and Mr Cameron to pay $1 million as partial redress to franchisees for the losses they suffered as a result of Ms Ali and Mr Cameron’s conduct.”

“Both individuals were also disqualified from managing corporations in Australia, with Ms Ali disqualified for five years and Mr Cameron for four years.”

This billboard is missing a few words - "Watch us grow, with your money hah!"

________________________________________________________________________________________________________________________________________________________

We have heard on the grapevine that Mr Reiter is going to sue Wikifrauds. Our informants, Mr Reiter's former client (Fraud 1 above), has stated that full support for us will be forthcoming in such an event. Meantime, potential clients of Mortgage Capital Partners and Reiter are warned not to deal with this man and his company, or with Charles Cameron.

June 2022: We have heard nothing further from Reiter about sueing us for defamation. Would that be because he knows he would lose. There is no defamation in truth is a well accepted legal doctrine.