Since starting Wikifrauds in February this year, we have had

numerous requests for assistance in fee recoveries or for performing

due diligence on behalf of many wary clients.

A number of major on-going frauds brought to our attention

have been exposed. But at the front end of many of these are a number

of brokers and mortgage originators who are prepared to take up-front

fees in return for procuring funding. This can be quite legitimate

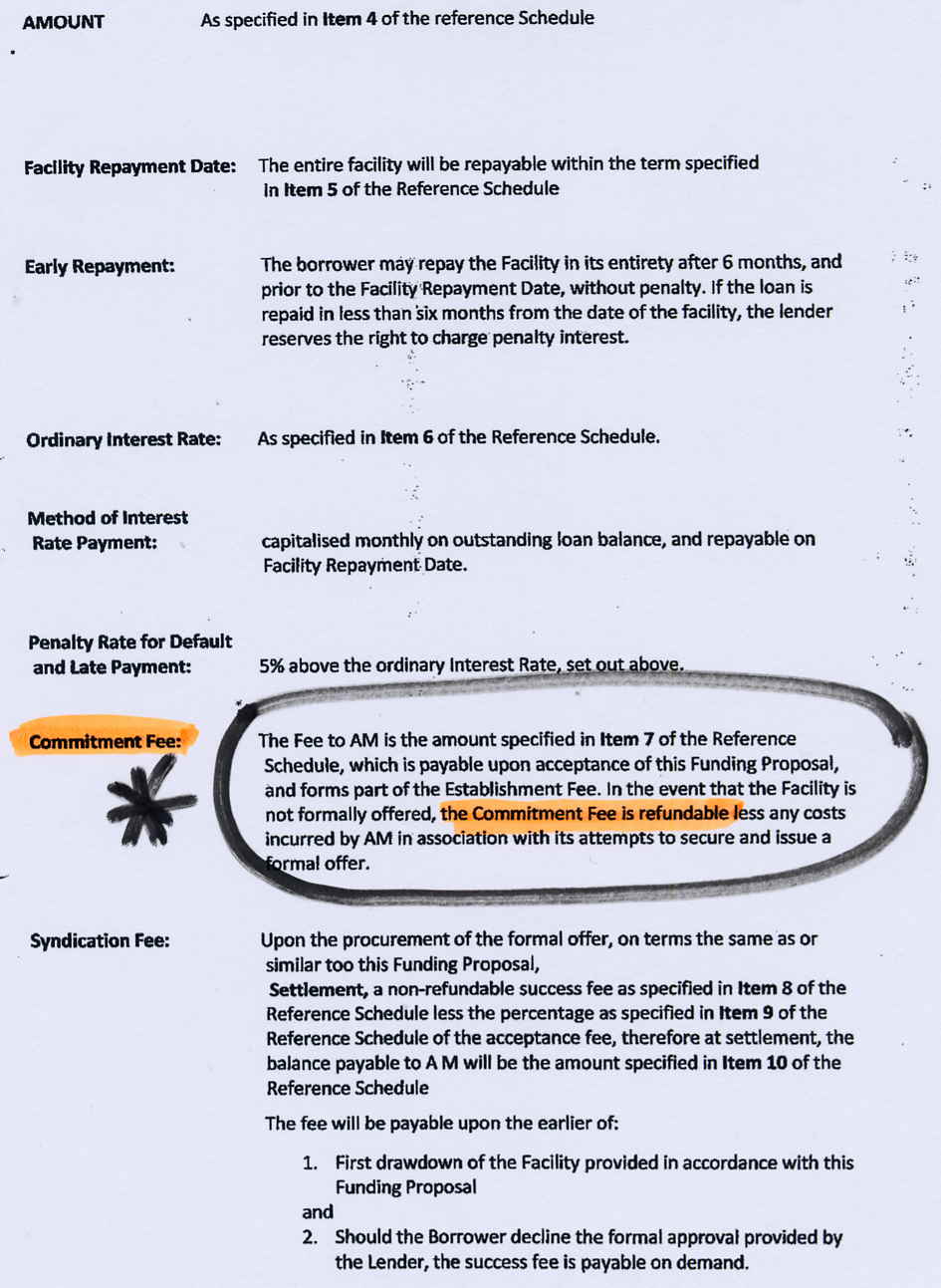

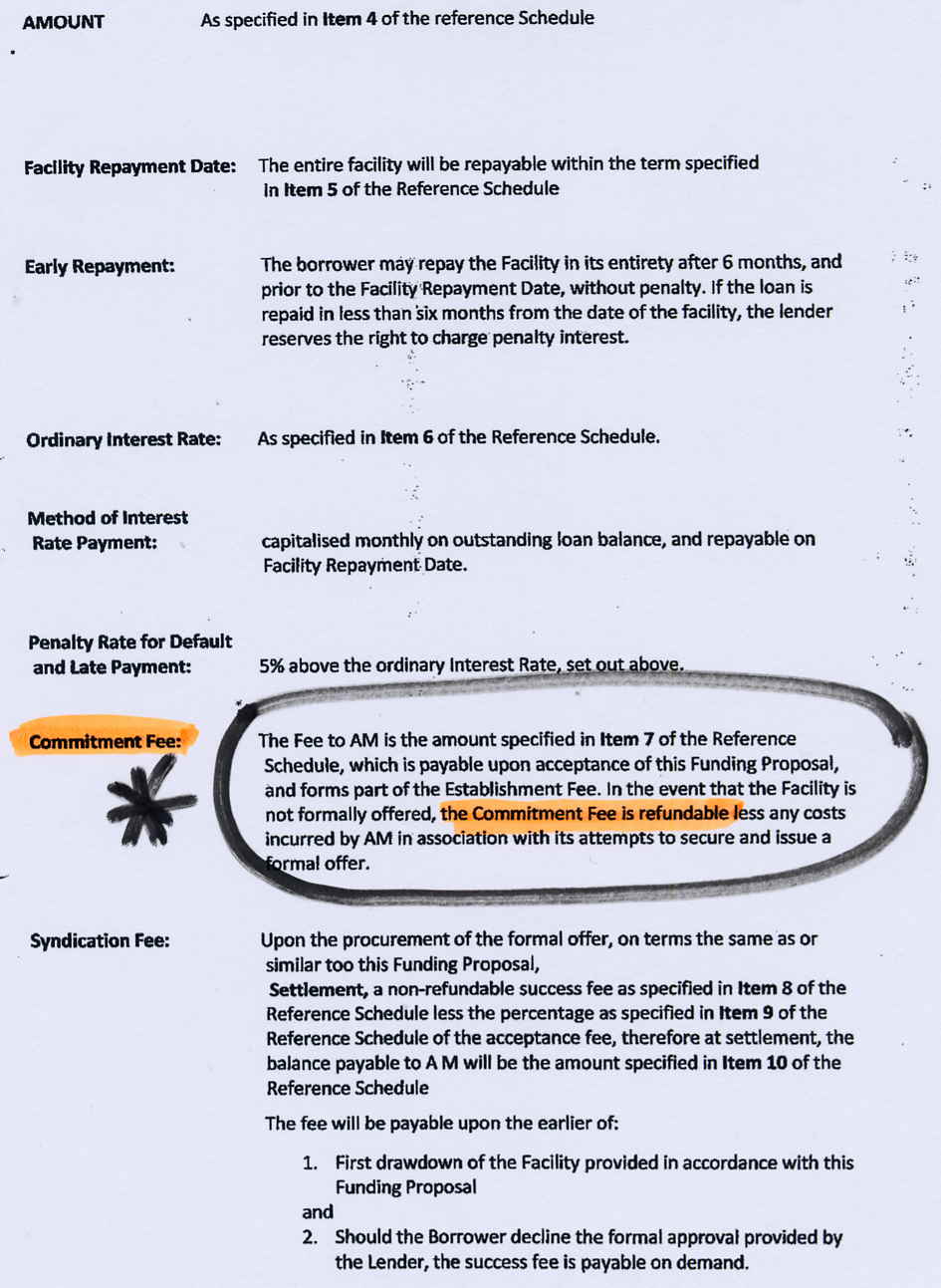

in most instances, but when a supposed loan originator issues terms

sheets wherein they state that all fees are refundable should a loan

not eventuate, then the loan applicants have a right and reasonable

expectation that these fees will be refunded.

On many occasions before we publish, we attempt to have people pay

back their contractual obligations. In an effort to secure a refund of

$22,000 in fees paid by our contact in Queensland, Wikifrauds twice

emailed Ainsworth in the last fortnight and sought the said refund. We

have seen no response from Ainsworth, and nor has the client received

anything but excuses.

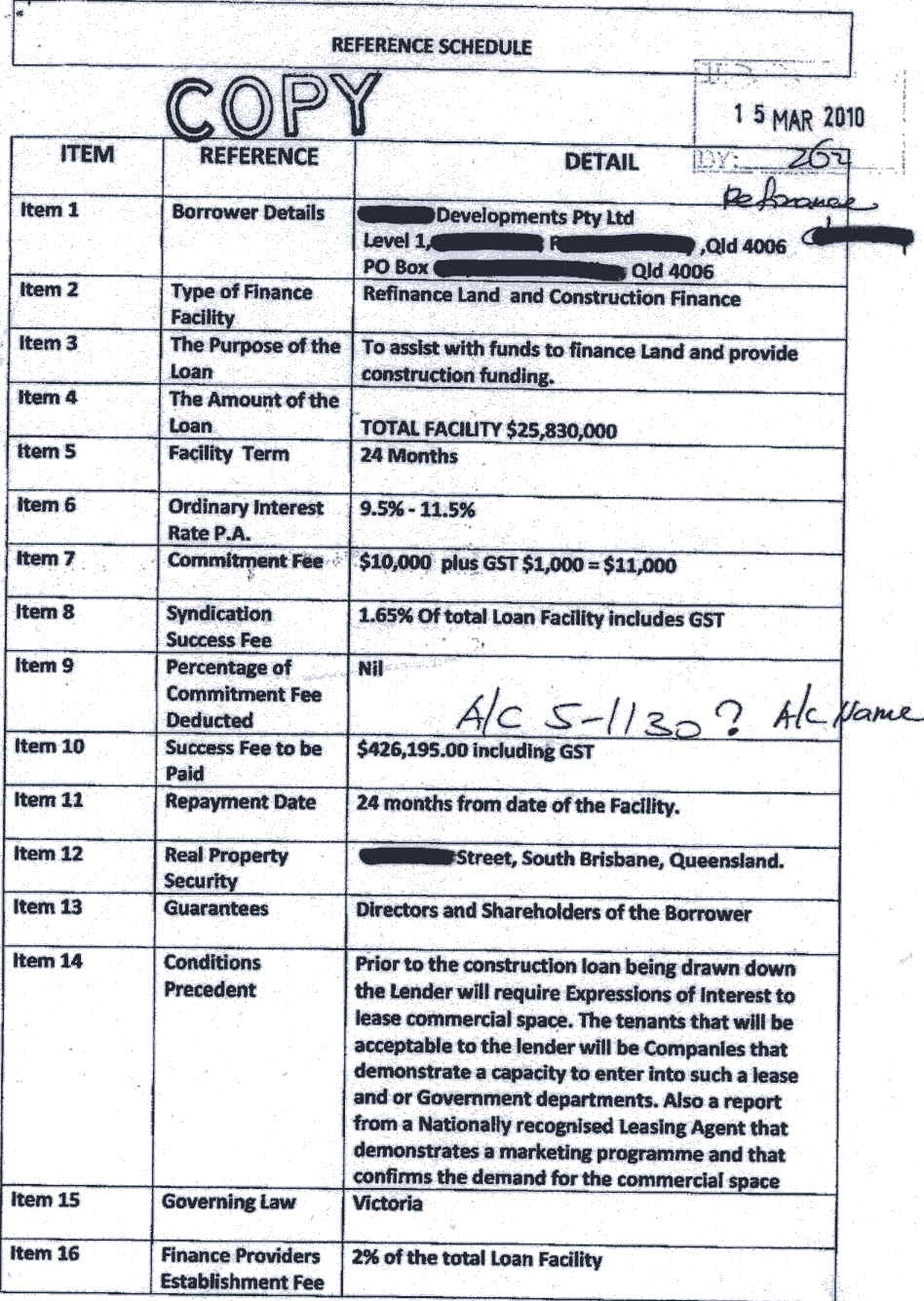

We have no alternative than to now produce the "loan

application documents" provided by the client. To protect the

client's commercial situation and to prevent embarrassment, we publish

these documents, but we have crossed out that client's name and company

details.

We have no problem with brokers and introducers charging modest

fees for work to be done, but we strongly object to those brokers who

issue terms sheets or other agreements and documents which seduce

investors or borrowers with the line that all fees are refundable. We

especially have problems with brokers who have not done their own due

diligence on funders they recommend, and continue to put applications

up to lenders they have become aware of who are scams, just so they can

collect more up-front fees on the way. There a quite a number of these

sort of people in Australia, and we are well aware of who many of them

are. They will get their names in the limelight on this site as

soon as time permits. The industry has no room for bottom-feeders like

Ainsworth and others.

Meanwhile, any readers who have had

similar experiences with Mr Ainsworth, or any other

dubious 'brokers' should

contact us for further

details.

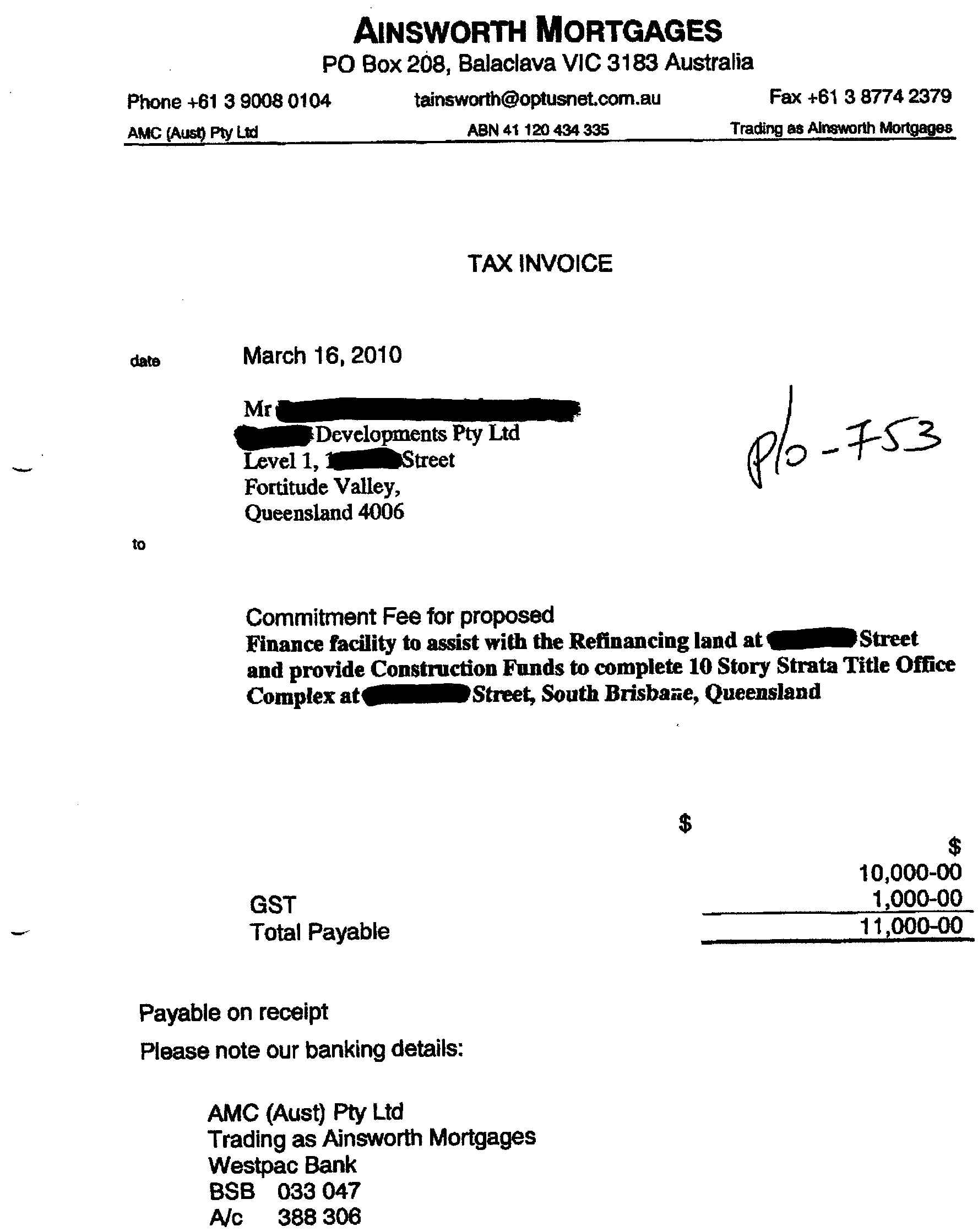

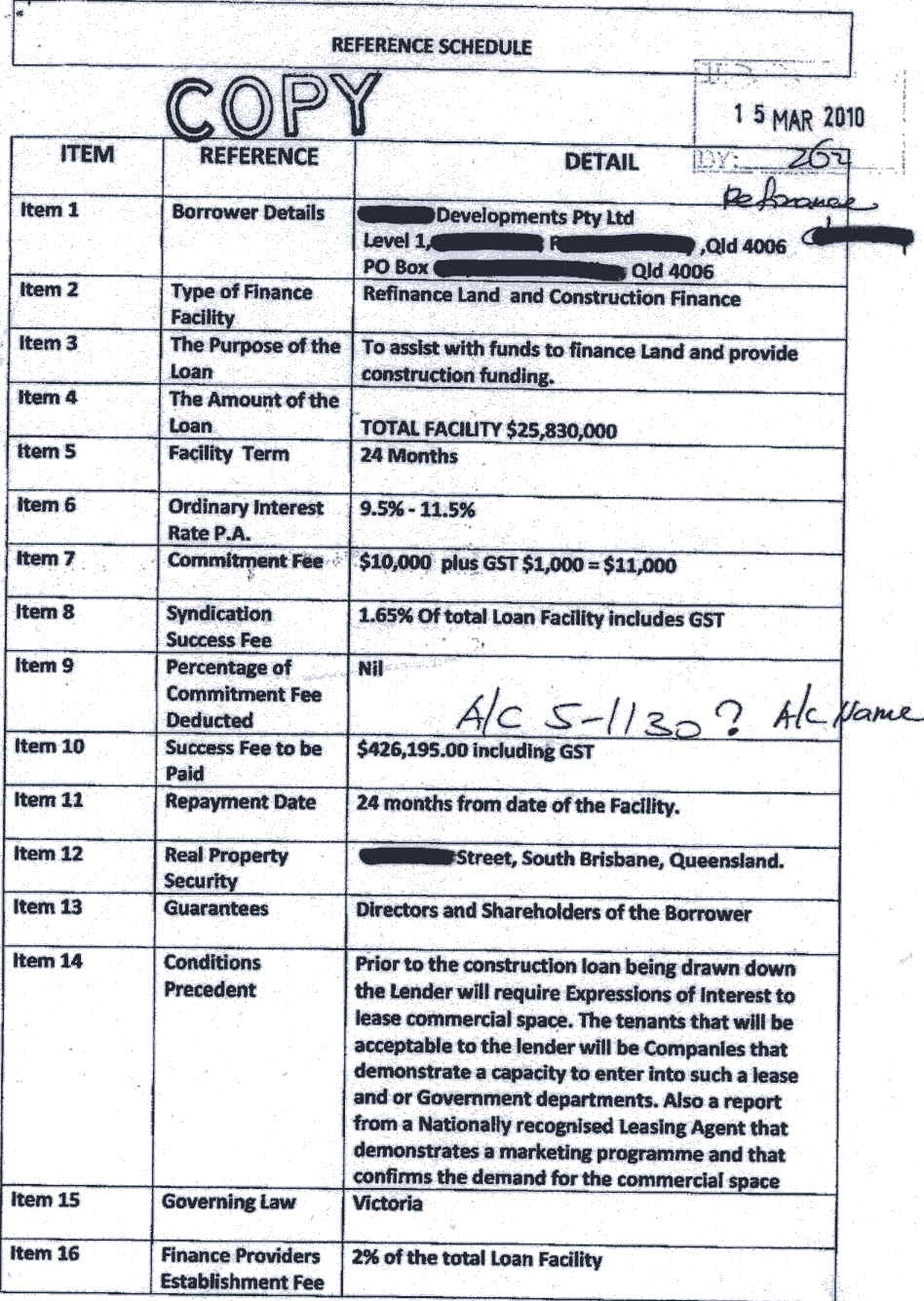

Pasted

below are a extracts from documentation issued by Ainsworth, one which

clearly shows the committment fee being refundable. Also pasted below

is a letter and subsequent emails which show this client's recent

requests

for his refund on two separate loan applications totalling some

$22,000. (We will show only one set of documents for one loan, the

other is almost the same, with the committment fee identical at $11,000

each).

We stress that this is from one client alone.

Since yesterday, October 5,

when we first published this page, we have recieved further information

relating to similar problems from another client.! We wonder how many

more will come out and expose this leech.

Letter to

Ainsworth from "Client":

Two Emails from

the client to Ainsworth:

From: "Client"

Two Emails from

the client to Ainsworth:

From: "Client"

Sent: Tuesday, 16 August 2011 11:37 AM

To: 'Tzvi Ainsworth'

Subject: refund

Mr.Ainsworth,

We, the Xxxxx

Group,as you know, in early 2010, signed a funding agreement with

you to refinance 2 projects.One at Xxxxx, The Gold Coast, and the other

in Yyyy St., South Brisbane.

In your

agreement, it states categorically, that should you not be able to

produce an offer to us, that you will refund the fee.To date, after 16

months, no offer has ever been presented.

We have already

tried to contact you thru mail and phone,with no joy.

Should you not

make contact or refund the $22,000 by this Friday, we will instigate

whatever means of recovering the money that we see fit.

In fact, we will

be in Sydney next week,and if necessary will come and discuss the

matter with you personally.

"Client" (04xx xxxxx0)

From: "Client"

Sent: Friday, 9 September 2011 3:30 PM

To: 'Tzvi Ainsworth'

Subject: RE: Finance

Application

Mr. Ainsworth,

Your mandate makes it very

clear that all fees refunded if a proposal is not put up.

You readily admit you have not

given us any formal offer of finance.

As far as Cordelia St.

goes,this was sold some 6 months after we commissioned you to find us a

funder. Did you expect us to wait over a year as we had for the

Apartment deal? If we do not receive our $22,000 by

Monday afternoon,I will forward your details onto the fraud

investigators for exposure.

"Client"

Oops!

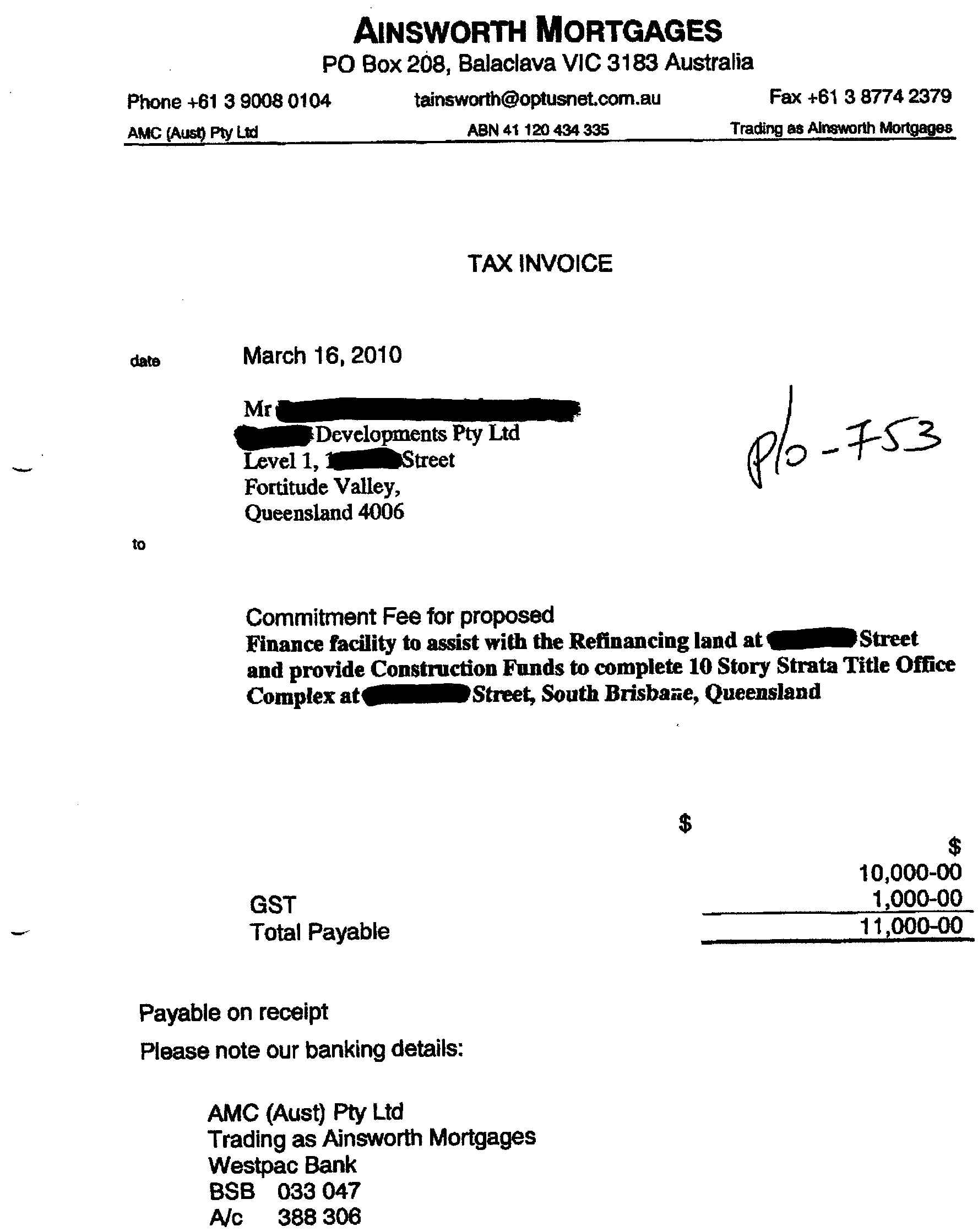

Second

client exposes Ainsworth!

Oct 13, 2011:

As we expected, another client of Ainsworth Mortgages has come forward

with a similar story to our first client. Again, a fee of $11,000

including GST (wonder if that GST ever got paid?. Our

friends at the ATO might want to look at that). And again, we have

blacked out the name of the applicant from the following documents.

This client paid his fees back in late 2009, never received any loan

offers, and to this date has been unable to secure his "refundable"

fee. This kind of behaviour from finance brokers and originators is not

tolerable. Ainsworth Mortgages should never be approached when

seeking a loan. It will only cost money and end up nowhere. And by the

way, Ainsworth Mortgages does not hold an Australian Financial Services

licence.

It is abundantly clear that

Ainsworth has no intention of honouring his contractual

obligations.

Wikifrauds strongly recommends that

intending borrowers steer well

clear of this bottom feeder.

Wikifrauds Disclaimer: This company is not to be confused with a

similarly named company operating in the UK

Welcome to

Wikifrauds

Welcome to

Wikifrauds

Welcome to

Wikifrauds

Welcome to

Wikifrauds